Just recently, the SEC lifted its ban on alternative investment vehicles advertising to the general public as amendmentsto Rule 506 of Regulation D, and Rule 144A went into effect on July 10.

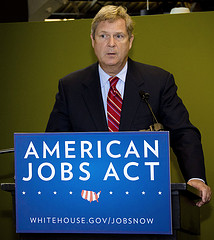

Mandated by the Jumpstart Our Business Startups (JOBS) Act, these new rules will make it easier for companies and private investment funds to raise capital by engaging in broader communications and marketing efforts. The only hitch is that these issuers take reasonable steps to verify that purchasers of the securities are accredited investors.

Without getting into the legal ramifications of what constitutes “reasonable steps to verify,” although securities law firm Paul Hastings does a pretty good job of highlighting some of its key elements, the new rules seem to be positive step for hedge funds and alternative investment vehicles looking to capture freed-up investor cash as a result of the economy’s turnaround.

Changes to these rules have been in the works since April 2012, when the JOBS Act was signed into law. While some alternative investment funds already have been exploring advertising options, very few have rolled out larger marketing or branding campaigns.

Not everyone may look at the new rule as a positive change. The exclusivity of these types of investments has created a certain cache among would-be investors, sort of like a country club-atmosphere, allowing only those with the “right” pedigree to gain access.

Maybe this is an extreme analogy, but there is some truth in jest. It’s probably a safe bet to say that an established $10 billon hedge fund may not be putting up a Facebook page. However, newer or lesser-known funds will be using the new rules to generate brand awareness among qualified investors. The result will force many of the firms not wanting to advertise to do something, especially since they will be overshadowed by funds that are marketing their investments more broadly.

Therein lies the quandary. Too much marketing will create brand dilution that will negatively affect perceptions among existing and prospective investors. Too little advertising just won’t generate attention. Finding the right mix of traditional and social media will be the correct strategy, although this will be extremely difficult in today’s Internet-based media landscape.

Positioning fund managers as experts across financial media and investor platforms sounds like an effective strategy and a good place to start, so does an ad in Forbes or the Wall Street Journal. The key here is to create or maintain cache. Otherwise, we’ll see more funds commoditized, possibly even banner ads on Google touting the latest alternative investment vehicle. Ok, maybe a stretch, but let’s see what happens anyway.